The tapering of the Personal Allowance means some higher-rate taxpayers effectively pay an Income Tax rate of 60%, sometimes without realising. Fortunately, if you’re affected, there could be ways to reduce your tax bill.

A report in the Telegraph suggests 1.35 million workers were affected by the 60% tax trap in 2023/24. Collectively, they paid an extra £4.7 billion to the Treasury. Read on to find out if you could unwittingly be paying a higher rate of Income Tax than you expect.

The tax trap affects those earning more than £100,000

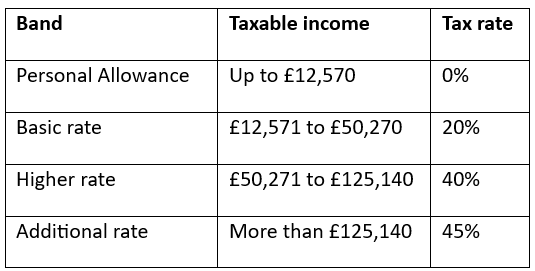

You might think the highest rate of Income Tax is 45%, and officially you’d be correct. Most people pay the standard rates of Income Tax. In 2024/25, Income Tax rates and bands are:

Please note, that different Income Tax bands and rates apply in Scotland.

However, the Personal Allowance is reduced by £1 for every £2 you earn over £100,000. If you earn more than £125,140, you don’t have a Personal Allowance and pay tax on all your income.

For example, if you earn £101,000, on the £1,000 above the threshold, you’d pay £400 of Income Tax at the higher rate. In addition, you’d lose £500 of your Personal Allowance, so this portion of your income would also be subject to Income Tax at 40%, adding up to £200.

So, out of the £1,000 you’ve earned above the tapered Personal Allowance threshold, you’d only take home £400 – a 60% effective tax rate. It’s led to the tapering being dubbed a “stealth tax” in the media.

Further compounding the issue is the fact that the Personal Allowance and Income Tax bands are frozen until 2028.

While the thresholds are frozen, many people are likely to receive wage increases. As a result, more people are expected to be caught in the 60% tax trap in the coming years.

Don’t forget your salary might not be your only income that’s considered when calculating your Income Tax bill. For example, you could be liable for interest earned on savings that aren’t held in a tax-efficient wrapper.

Contact us if you’re unsure which of your assets could be liable for Income Tax.

3 legal ways to avoid falling into the 60% tax trap

If you’re affected by the tapered Personal Allowance, thinking about how you structure your earnings may provide an opportunity to reduce how much you’re giving to the taxman. Here are three excellent options you might want to consider.

1. Boost your pension contributions

One of the simplest ways to avoid paying 60% tax if you could be affected is to increase your pension contributions.

Your taxable income is calculated after pension contributions have been deducted. As a result, boosting pension contributions could be used to reduce your adjusted net income so you retain the full Personal Allowance or reduce the proportion you lose.

Increasing pension contributions could help you secure a more comfortable retirement too. However, keep in mind that you cannot usually access your pension savings until you’re 55 (rising to 57 in 2028).

2. Use a salary sacrifice scheme

If your workplace has a salary sacrifice scheme, it could also provide a useful way to reduce your overall tax liability.

Salary sacrifice enables you to exchange a part of your salary for non-cash benefits from your employer. This could include higher pension contributions, childcare vouchers, or the ability to lease a car.

By essentially giving up part of your income, you might be able to bring your taxable income below the threshold for the tapered Personal Allowance.

You should note that salary sacrifice options vary between employers, so it may be worthwhile to check your employee handbook to see if any options could suit you.

3. Make charitable donations from your income

If you’d like to reduce your Income Tax bill and support good causes, you could make a charitable donation. Again, by deducting donations from your salary before tax is calculated, you could manage how much of the Personal Allowance you lose.

Contact us to talk about how to manage your tax bill effectively

There may be other steps you could take to reduce your overall tax bill. A tailored financial plan will consider your tax liabilities, including from other sources, such as your savings and investments, to highlight potential ways to cut the amount you pay to the taxman.

If you’d like to arrange a meeting, please get in touch.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of investments and any income from them can fall as well as rise and you may not get back the original amount invested.

Past performance is not a guide to future performance and should not be relied upon.

HM Revenue and Customs’ practice and the law relating to taxation are complex and subject to individual circumstances and changes which cannot be foreseen.

Approved by The Openwork Partnership on 12/07/2024.

More posts like this

Sign up to our newsletter

January 20, 2026

Homeowners opt for flexibility over a “forever home”

January 19, 2026

What is the bank rate, and why it could affect your mortgage?

January 19, 2026

4 key Budget announcements that could affect landlords

January 19, 2026

Gifting to reduce an Inheritance Tax bill? Here are 5 things to check first

January 19, 2026

How fiscal drag could harm your finances as the government extends tax freezes

January 19, 2026

How much should you contribute to your pension?

December 18, 2025

7 unbelievable travel experiences Lonely Planet recommends in 2026

December 18, 2025

2026 property market predictions and what they mean for you

December 18, 2025

How to protect your home in case of income loss

December 18, 2025

7 factors mortgage lenders review when assessing your application

December 18, 2025

Is the default pension fund right for you?

December 18, 2025

Explained: The new Cash ISA rules and what they mean for your savings

November 26, 2025

Your Autumn Budget update, and what it means for you

November 20, 2025

The Bank of England is predicted to cut interest rates in 2026

November 20, 2025

The 5 essential decisions you need to make when taking out a new mortgage

November 20, 2025

Mortgage repayments are up 47% in 5 years. Here’s how you could cut yours

November 20, 2025

3 steps you can take to financially prepare for illness

November 20, 2025

The difficult but important estate planning conversations to have with your family

November 20, 2025

3 valuable ways to create a guaranteed income in retirement

October 21, 2025

How to impress the only person that matters

October 21, 2025

Investment market update: September 2025

October 21, 2025

The pros and cons of overpaying your mortgage

October 21, 2025

How the Labour government could change Stamp Duty in the Autumn Budget

October 21, 2025

3 reasons why pension consolidation could boost your retirement income

October 21, 2025

Phasing into retirement: The flexible options you might consider

September 24, 2025

Investment market update: August 2025

September 24, 2025

5 stunning winter destinations that are perfect for a last-minute break

September 24, 2025

Taken out a new mortgage? Don’t forget to review your financial protection

September 24, 2025

What could a Labour wealth tax look like?

September 24, 2025

Why the Labour government could reform the State Pension and what it means for you

September 24, 2025

The 3 steps to achieving financial wellbeing

August 14, 2025

When is the right time to fix your mortgage interest rate?

August 14, 2025

2 key mortgage options if you’re moving up the property ladder

August 14, 2025

Explained: Why overpaying your mortgage could save you thousands of pounds

August 14, 2025

Think cash is king? It might be time to review your mantra

August 14, 2025

Unsure how to access your pension at retirement? Here’s what you need to know

August 14, 2025

4 times you might want to review your financial plan

July 30, 2025

5 powerful Warren Buffett lessons that could benefit ordinary investors

July 23, 2025

Everything you need to know about Stamp Duty

July 23, 2025

The pros and cons of choosing a shorter mortgage term

July 23, 2025

5 valuable reasons to consult a solicitor when writing your will

July 23, 2025

The age you can access your pension may rise. Could it affect your retirement?

July 23, 2025

The secret to a happy life

June 17, 2025

9 stunning beaches to explore in the UK this summer

June 17, 2025

The pros and cons of choosing a 100% mortgage

June 17, 2025

The mortgage essentials you need to know when downsizing

June 17, 2025

4 steps that could recession-proof your retirement

June 17, 2025

3 valuable ways a financial plan could help you navigate a relationship breakdown

June 17, 2025

Why defining “financial freedom” could help you achieve it

May 16, 2025

Why tariffs and a trade war could mean your mortgage interest rate rises

May 16, 2025

The tricks that could shorten your mortgage term

May 16, 2025

5 shrewd ways to avoid paying tax on your savings

May 16, 2025

How to use an unexpected windfall to create long-term prosperity

May 16, 2025

Financial protection: The key options that could protect your lifestyle and family

May 16, 2025

Does money make us happy?

April 22, 2025

Investment market update: March 2025

April 22, 2025

4 reasons to remain calm amid market volatility and uncertainty

April 22, 2025

Majority of parents worry about critical illnesses. Here’s how financial protection could help

April 22, 2025

The AI technology that means you need to be vigilant for scams more than ever

April 22, 2025

5 strategies that could help you avoid running out of money in retirement

April 22, 2025

How much do you need to be “wealthy”?

March 10, 2025

The potential perils of accessing your pension at 55

March 10, 2025

The financial wellbeing equation

March 10, 2025

Investment market update: February 2025

March 10, 2025

Could overpaying your mortgage save you thousands of pounds?

March 10, 2025

3 ways your property could be taxed as a homeowner

March 10, 2025

Thinking about investing in crypto? You need to be aware of these signs of a scam

February 26, 2025

Business owners: 5 reasons you could benefit from saving into a pension

February 21, 2025

5 practical tips for staying healthy in your 50s and beyond

February 21, 2025

European hidden gems that are perfect for a spring break

February 21, 2025

5 unexpected factors that could affect the value of your home

February 21, 2025

3 reasons why your mortgage interest rates could fall this year

February 21, 2025

State Pension: Everything you need to know in 2025/26

January 10, 2025

How you could take advantage of falling interest rates

January 10, 2025

3 insightful property market predictions for 2025

January 10, 2025

5 practical tasks that could help you get more out of your pension in 2025

January 10, 2025

5 useful allowances and exemptions that will reset at the end of the tax year

January 10, 2025

Plans changed? Updating your financial plan could offer reassurance

January 10, 2025

The compelling benefits of building a tailored financial plan

December 04, 2024

3 helpful ways the Bank of Family could support aspiring homeowners

December 04, 2024

Investment market update: November 2024

December 04, 2024

Lonely Planet’s top 10 holiday destinations for 2025

December 04, 2024

What the 2025 Stamp Duty changes mean for the property market

December 04, 2024

The pros and cons of choosing joint life insurance

December 04, 2024

The key Autumn Budget takeaways business owners should be aware of

November 20, 2024

Interest rates are predicted to fall to 3% next year and could slash mortgage repayments

November 20, 2024

5 savvy ways you could pay off your mortgage sooner

November 20, 2024

The voice cloning AI scam you need to be aware of

November 20, 2024

5 smart reasons why retirement planning should start in your 30s and 40s

November 20, 2024

4 valuable ways lifetime cashflow forecasting could give you financial confidence

November 20, 2024

2 key Budget announcements that may affect your financial plan

October 30, 2024

Your Autumn Budget update – the key news from the chancellor’s statement

October 11, 2024

What’s an affordable amount to spend on your mortgage?

October 11, 2024

5 things every first-time buyer needs to know about mortgages

October 11, 2024

How would soaring property prices affect a 2024 Monopoly board?

October 11, 2024

2 valuable types of financial protection to consider if you have a family

October 11, 2024

Could a financial plan give you the confidence to retire sooner?

October 11, 2024

Inheritance Tax: How does the UK compare internationally?

September 24, 2024

How to beat the winter blues this year

September 24, 2024

The potential money saving benefits of locking in a mortgage deal early

September 24, 2024

74% of financial advice from social media leads to an “undesired outcome”

September 24, 2024

Regular financial reviews may help you get more out of every stage of life

September 24, 2024

How to use your mortgage to fund a renovation project

September 24, 2024

5 sensible steps to take if your fixed-rate mortgage deal ends in 2024

August 13, 2024

Two-thirds of UK adults don’t have a will. Here’s how it could affect your legacy

August 13, 2024

Research: Lifestyle changes could relieve the symptoms of Alzheimer’s

August 13, 2024

How your mortgage interest rate affects the cost of borrowing

August 13, 2024

What does a Labour government mean for the property market?

August 13, 2024

4 unpredictable life events that could mean you’d benefit from a financial review

August 13, 2024

Why tuning out political speculation may help you stick to your financial plan

July 16, 2024

How to select a mortgage that’s right for you from thousands of options

July 16, 2024

More than half of homeowners don’t have enough life insurance to protect them

July 16, 2024

How to effectively protect your identity and your finances from criminals

July 16, 2024

Higher-rate taxpayers: Beware of the 60% tax trap

July 16, 2024

78% of retirees could be missing out on investment returns by accessing their pension early

July 16, 2024

The surprising effect your childhood has on your money mindset

June 14, 2024

Investment market update: May 2024

June 14, 2024

Here’s how rising interest rates have affected the property market

June 14, 2024

Uncertainty drives record numbers to take out income protection. Here’s what you need to know

June 14, 2024

Explained: When do you need to declare the interest earned on savings?

June 14, 2024

3 practical ways you could reduce your tax bill in retirement

June 14, 2024

How a financial plan could alleviate your inflation worries

May 16, 2024

8 fantastic reasons to support local causes for Small Charity Week

May 16, 2024

10 unexpected effects of the work-from-home trend

May 16, 2024

1 in 5 people expects to be paying their mortgage in retirement

May 16, 2024

Should you wait for interest rates to fall before fixing your mortgage?

May 16, 2024

The essentials you need to know about critical illness cover

May 16, 2024

4 compelling reasons you might want to consolidate your pension

April 23, 2024

6 delicious holiday destinations that promise to be perfect for foodies

April 23, 2024

Unpaid overtime totalled £26 billion in 2023. Here are 5 practical tips for seeking more support

April 23, 2024

First-time buyers still face major challenges as the Budget overlooked support

April 23, 2024

Mortgage holders could benefit from rising property prices as an average sale made £74,000 in 2023

April 23, 2024

Running out of money tops retirement concerns, but financial planning could bring peace of mind

April 23, 2024

What you need to know about taking your pension tax-free lump sum in 2024/25

March 19, 2024

Are you risking a pension shortfall by overlooking longevity?

March 19, 2024

Here’s what you need to know about the “Magnificent Seven” stocks that are driving the market

March 19, 2024

Retirement planning: The 3 main ways you could access your pension

March 19, 2024

3 savvy tips that could help you pay off your mortgage sooner

March 19, 2024

How to calculate the level of income protection that would provide you with financial security

March 19, 2024

1.5 million households could see their mortgage repayments soar when their deal ends in 2024

February 09, 2024

Could 25-year fixed-rate mortgages soon provide borrowers with peace of mind?

February 09, 2024

The government could launch 99% mortgages to support first-time buyers

February 09, 2024

Mortgage availability is rising. Here’s what to consider when narrowing down your options

February 09, 2024

A Lasting Power of Attorney could offer protection at every life stage

February 09, 2024

5 handy tips that could help couples create an effective financial plan

February 09, 2024

The ups and downs of the FTSE 100 40-year history demonstrates time in the market matters

January 10, 2024

The feel-good news stories you might have missed in 2023

January 10, 2024

Why taking out life insurance alongside your mortgage could provide peace of mind

January 10, 2024

4 insightful property market predictions for 2024

January 10, 2024

3 important figures to review on your payslip to manage your short- and long-term finances effectively

January 10, 2024

The 3 essential pension decisions you should review to avoid becoming a “triple defaulter”

January 10, 2024

Retirement planning: Should you consider a phased retirement?

December 18, 2023

Why joining the “5 am club” could boost your productivity and wellbeing

December 18, 2023

How overpaying your mortgage could save you money in the long term

December 18, 2023

Housing shortage: Could a downsizing Stamp Duty relief provide a solution?

December 18, 2023

IMF predicts interest rates squeezing mortgage holders won’t start to fall until 2028

December 18, 2023

The families of 6 in 10 over-75s could face challenges if they lose mental capacity

December 18, 2023

2 Autumn Statement announcements you may have missed that could simplify your finances

November 23, 2023

Investment market update: October 2023

November 23, 2023

Why an offset mortgage could cut your mortgage repayments and provide flexibility

November 23, 2023

Should you choose a fixed-rate mortgage when your current deal ends?

November 23, 2023

Did you use the Help-to-Buy scheme? Inflation could affect your repayments

November 23, 2023

How much life insurance will provide your family with security?

November 23, 2023

How to help your family manage your affairs when you pass away

October 31, 2023

Investment market update: September 2023

October 31, 2023

5 practical steps first-time buyers can take to make putting in an offer smoother

October 31, 2023

Half of mortgage borrowers stick with their lender, but it could mean paying more interest

October 31, 2023

3 essential factors to consider if you plan to gift wealth to avoid Inheritance Tax

October 31, 2023

HMRC collects a record amount in Capital Gains Tax. Here’s how you could manage your liability

October 31, 2023

Here’s why pension reforms mean you might want to reconsider your retirement plan

September 30, 2023

Investment market update: August 2023

September 30, 2023

The Bank of England warns mortgage repayments could jump by £500 for 1 million households

September 30, 2023

Soaring interest rates are driving more people to consider interest-only mortgages

September 30, 2023

The 2023 parents’ essential guide to student loans

September 30, 2023

7 practical reasons to make a Lasting Power of Attorney now

August 30, 2023

5 powerful reasons to learn more about your pension today

August 30, 2023

A grocery shop would cost just 45p in 1940s when the first supermarket opened its doors

August 30, 2023

Here’s what mortgage lenders consider when carrying out affordability tests

August 30, 2023

4 practical steps landlords can take to protect their income

August 30, 2023

Choosing the right financial protection when you take out a mortgage could boost your mental health

August 30, 2023

Investment market update: July 2023

August 30, 2023

6 practical steps to take if you have a “credit blip” and want to apply for a mortgage

July 31, 2023

Do you need to plan for a retirement without the State Pension?

July 31, 2023

7 common but potentially harmful Inheritance Tax myths debunked

July 31, 2023

8 in 10 first-time buyers risk inaccurate information as they turn to social media for tips

July 31, 2023

The 3 types of tax you need to understand before investing in buy-to-let

July 31, 2023

These are the 5 core traits of the wealthy, according to an interesting study

June 30, 2023

7 beautiful European destinations if you want to explore nature

June 30, 2023

5 practical steps to speed up buying or selling property

June 30, 2023

Want to retire early? Financial planning could make it a reality

June 30, 2023

5 compelling non-financial reasons to work with a financial planner now

June 30, 2023

100% mortgages return to the market. Are they a solution for first-time buyers?

June 30, 2023

As interest rates soar, should you remortgage your home in 2023?

May 31, 2023

Received an inheritance? Here’s why you should consider boosting your pension

May 31, 2023

5 essential money lessons that could improve your child’s financial independence

May 31, 2023

Could property present a viable alternative to pension savings for retirement?

May 31, 2023

Selling your home? These 10 simple changes could help you increase its value

May 30, 2023

4 red flags that could be signs of a scam and what you need to know about them

April 30, 2023

Self-employed? Read these 6 useful tips before applying for a mortgage

April 30, 2023

Forget the new year, spring is the perfect time to set new goals

April 30, 2023

Investment market update: March 2023

April 30, 2023

New-build properties often have a premium, but there are positives too

April 30, 2023

4 valuable ways a financial planner can help you tackle “overwhelming” pension information

April 30, 2023

The FTSE 100 reached an all-time high despite recession fears

March 31, 2023

Earth Day 2023: Small but powerful ways you can improve the environment

March 31, 2023

Can you guess the average house price on the most expensive street in the UK?

March 31, 2023

3 useful ways a mortgage broker can help you navigate a market that changes quickly

March 31, 2023

Missing financial protection triggers could leave you vulnerable to shocks. Find out why here

March 31, 2023

5 practical things to check as part of a financial midlife MOT

March 31, 2023

Explained: How pension tax relief works and boosts your retirement savings

February 28, 2023

Explained: Your 3 main options when accessing your pension for the first time

February 28, 2023

Identity theft: Discover 5 useful tips to protect yourself as cases double

February 28, 2023

5 useful ways the Bank of Mum and Dad could help first-time buyers

February 28, 2023

Millions of fixed-rate mortgages are ending. Discover 6 practical steps you can take now

February 28, 2023

100 British companies back the 4-day working week. Could it start a workplace revolution?

February 28, 2023

Investment market update: January 2023

January 31, 2023

5 fantastic reasons to work with a mortgage broker

January 31, 2023

61% of Brits feel stressed about later-life planning. Here are 5 things you can do to boost your confidence

January 31, 2023

5 surprising financial planning lessons you can learn from the release of Avatar 2

January 31, 2023

7 important things you should check on your credit report before you apply for a mortgage

January 31, 2023

How to set out goals to achieve success in 2023

January 31, 2023

Here’s what happened in the property market in 2022 and how it’ll affect this year

February 03, 2022

Sample post

February 03, 2022

Sample post

February 03, 2022

Sample post

February 03, 2022

Sample post

February 03, 2022

Sample post

February 03, 2022

Sample post

February 03, 2022

Sample post

February 03, 2022

Sample post

February 03, 2022

Sample post

February 03, 2022

Sample post

February 03, 2022

Sample post

November 29, 2018